…This at least is duty; duty and profit hand in hand.

Starbuck in Herman Melville’s Moby Dick

It’s something of a truism that financial markets are obstacles to climate action. Nevertheless, some sections of the financial world are addressing themselves to climate change, predictably in search of returns on investment. More worryingly, they are being enabled by governments, and the resulting ‘market-based solutions’ are absorbing some of the political energy directed towards the climate crisis.

In monetary terms, investment firms have both a lot to answer for and a lot to supply in terms of achieving the pace of transition required to mitigate some of the catastrophic effects of climate change. Pragmatists on the left, including proponents of the Green New Deal, eye the enormous resources floating around in the financial world as possible sources of green investment. Adrienne Buller’s The Value of a Whale answers this temptation with a firm, detailed ‘No.’

*

If our opposition to capitalism and financialisation is settled, what can a book like Buller’s contribute to left debates about climate change? On the one hand, it is important to understand the dynamics of green capitalism as they alter the environment. On the other, the moral case for climate action cannot, structurally, alter the fundamental governing principles of capitalism and its exemplary institutions. Capitalism is not a contingent or incidental barrier to climate action and justice: it is necessarily opposed to any conception of value or rationale for action other than profit.

Buller shows how ‘green capitalism’ perpetuates a system of accumulation while maintaining legitimacy in the face of increasing opposition. This opposition is not a feature, however, of Buller’s account, nor is the book an analysis of labour’s role in financial capitalism or climate action. Class does not feature as a prominent factor in Buller’s argument. Rather, The Value of a Whale is an eerily agent-less account of green capitalism.

This is appropriate to the inhuman, impersonal dynamics of the financial world. Indeed, abstractions ‘so extreme as to be indefensible,’ as Buller writes, are its currency. Part of the destructive motor of financial capitalism is its grinding degradation of anything that doesn’t fit into double entry accounting columns.

The Value of a Whale is split between describing this world—which requires a degree of immersion in its language—and voicing opposition. Buller is clear that ‘market-based solutions do not offer a path to safety for the world’s majority, let alone a future that is defined by collective abundance and wellbeing.’ Financialisation instigates anti-political, anti-democratic (in)action, and sanctifies it with green branding that aims to disguise its continued role in destruction and dispossession.

Buller states that the aim of her book is ‘naming an adversary,’ but we need more than this—and the book provides an analysis that could inform effective opposition to green capitalism.

The sacraments of financial capitalism

The methods developed under capitalism to exploit nature since its inception have been codified into doctrine under financial capitalism. What was an unstated input into the accumulation, exploitation and expropriation of value has been transformed by its abstraction into financial markets and bundling via securities and derivatives. No longer do capitalists have to demonstrate the profitability of their ventures by digging and feeding the dirty engines of growth. Now they can trade stocks on exchanges many times removed from the coal- (or cobalt-, or lithium-)face.

Financialisation intensifies the opportunities for capital accumulation and, according to Buller, has four main features. Following Dieter Helm’s attempt to inculcate natural inputs into market calculations in a language they understand—capital—Buller lists substitutability, fungibility, rivalry and excludability as essential for constituting nature as conceived by financial capitalism.

Substitutability reduces things to exchangeable units, so that, in Helm’s words ‘for every new bit of damage, there has to be a compensating increase in renewable natural capital elsewhere.’ Nature is homogenised into a single source of monetary value and—provided you compensate for any damage created by extraction and exploitation—no harm is chalked up. If one species goes extinct, it doesn’t count as a loss provided there is an ‘equivalent’ gain in another species.

Fungibility also reduces natural entities to standardised units that can be replaced but operates on the same type of thing. In Buller’s example, a forest is made more productive (in the short term) by cultivating identical trees in neat rows. Of course, the cost on the ecosystem is incalculable but once things fit into readily reproducible and standardised units, we can value them accurately.

Rivalry and excludability picture the world as a competition for resources that are either scarce or can be cordoned off by enclosure so that someone can restrict the supply and therefore price them.

Each of these principles re-shapes ‘nature’ into exchangeable units available for financial market transactions. They do violence to the reality of ecological integrity and carefully sieve away any sense of other kinds of values we might associate with our connection to the natural world.

Beyond simply carving and parcelling nature, capitalism also re-makes it ‘on an unprecedented scale.’ The active production of both our real relation to nature and our ideas and language for it are concealed by the terms of financial capitalism, and its appearance as ‘a politically neutral, pragmatic shift’ to fix the problem of ‘externalities.’ Similarly, the claims of green capitalism are presented as an historic transformation in the economy. But, as Buller argues, the ‘investing’ that takes places in financial markets often has little to do with genuine ‘investment’ in decarbonisation and transition technologies. Profit on financial markets is uncoupled from any real contribution to climate action.

Nevertheless, proponents develop measures to justify the use of ‘market-based solutions.’ They often incorporate the aura of objectivity and science as cover for the errors and assumptions inevitably incurred by adopting hegemonic politics. For example, the ‘Social Cost of Carbon’ calculation is meant to measure the ‘monetary costs of the damages inflicted by every additional unit of carbon emitted.’ It is upheld (albeit implicitly) as the standard for measuring the costs of climate change, yet Buller argues that it is ‘imperfect’ and ‘politically contestable.’ Like many such measures, its exclusions are more revealing that its inclusions, based as it covers only sectors of the economy with sufficient data to ‘reliably predict climate impacts,’ therefore neglecting critical industries. The measure isolates and quantifies what in reality are cascading effects with more than just monetary costs.

Similarly, the ‘ESG’ framework claims to account for environmental and social impacts, but its purpose is not to ‘drive change in the real economy,’ Buller contends. Rather, ‘it is a strategy based on reducing financial impacts, not material ones.’ Ethical investing (that contradiction in terms) is also not directed towards actually contributing to an ecologically sustainable economy, but rather betting on its likelihood without actually making it happen. Mere disinvestment from fossil fuels is no real action, it simply protects capital from risks (both to brand and bottom line) now associated with such activities.

Economics is a discipline guided by a commitment to efficiency. Climate action, by contrast, demands a commitment to efficacy. The two are often conflated in economic analyses of climate change, weighing up particular actions based on their cost-effectiveness. But most people would pay just about anything to prevent the catastrophic effects of climate change.

Efficiency, Buller reminds us, cares not for justice or fairness. While carbon markets are touted as the best way to generate ‘efficient distributions of the right to emit,’ they may play no role in actually reducing carbon emissions. Clearly our efforts should be directed towards effective, not merely efficient actions.

Non such actions will be forthcoming if we follow the advice of stalwart of climate economics William Nordhaus, who wrote that ‘Good policies must lie somewhere between wrecking the economy and wrecking the world.’ The obscenity of the implications of this claim follow gently from the process of following through a kind of economic thinking to its ends, utterly divorced from the knowledge or reality of its effects. Nordhaus was instrumental in developing models of climate impacts ‘for the rose-tinted long run,’ as Geoff Mann contends. Nordhaus’ models ‘underestimate the scale and scope of the economic impacts of climate change’ and imply that ‘global warming is best treated as a change in the cost structure associated with shifting temperatures: capitalism plus wind turbines.’

Ethical asset management

Buller’s book intervenes in debates about the shape of contemporary capitalism to connect the rise of asset management with that of green capitalism. Asset managers play such a large role in financial markets that some critics, such as Benjamin Braun and Buller herself, argue they constitute a specific form of capitalism. Asset management, unlike active investing by hedge funds and other financial firms, has unique features which make it a significant factor in the shape of so-called ethical investing.

What is notable about this regime of capital allocation is that so many of us, willingly or unwillingly, are involved and invested in it. Anyone with a super fund, for example, has a stake in asset management, relying on the super account to at least keep pace with inflation, and more likely make a return. Since the wave of banking deregulation in the eighties and nineties, ordinary banking is increasingly enmeshed in financial markets and fund management. Although, as Buller writes, ‘this distribution has entangled record numbers of people in financial markets,’ the gains that most make pale in comparison to those made by the rich.

Fund management firms such as BlackRock, Vanguard and State Street have concentrated ownership of financial assets to an unprecedented degree. These three firms control up to 80 per cent of the market in asset management, and control over $US100 trillion. This constitutes a fundamental alteration in ‘how capital is allocated and the future constructed.’ Part of what makes it unique is the methods by which allocation is directed. These funds operate at volume, relying on abstraction, prediction, amalgamation and standardisation to streamline decisions about billions of dollars. They lean heavily on rating agencies and stock exchange indices, which are shaped by concealed political interests and tend to be status quo-preserving. Nevertheless, most firms these days have an arm that services customers with concerns about climate change, developing products like ‘sustainability funds’ or ‘ethical funds’ to appease the strained conscience of asset owners.

Buller argues that these labels are not only an instance of green-washing, but exist in contradiction with the main incentives, interests and modes of operation of these asset management firms.

For instance, because many of the funds are passively allocated (meaning they simply track indices, rather than make active investment decisions), they are invested in overall asset inflation and economic growth in the whole economy. The nature of index-tracking means many are passively invested in major fossil fuel companies and—despite some voicing commitments to ‘net-zero’ funds—there are no legal requirements that they follow through. Nor does their commitment require any active investment in green infrastructure to actually enable a carbon-neutral economy.

Nevertheless, asset management is now a powerful force in financial markets, forcing corporations to make decisions based on indexing and rating agencies. If any were tempted to invest in long-term, low-return infrastructure to fund the green transition, they would risk being punished by asset managers with a fiduciary duty to maintain returns. BlackRock has also developed its own portfolio analytic software corporations can license to cut costs, making them more heavily reliant on the firm. Like major technology firms, asset management increasingly blurs the line between ‘measuring and reproducing the past, predicting the future and creating it.’

If the professional managerial class embodies a novel post-war bloc that weaponises moral and professional credentials to stabilise class relations and maintain the regime of capital accumulation, the asset manager class is sustained by the power it wields in the economy. Having renounced the entrepreneurial foresight of the active investor, the asset manager combines the technocrat and the banker in perfect synchrony with the dominant style of economic policy in the rich world.

Into this class, so-called ‘activist’ investors seek influence, like your friendly local billionaire Mike Cannon-Brookes (upon whom The Age has lavished no fewer than seventy glowing stories since 2022, and hundreds prior), or the activist investor darlings ‘Market Forces.’ It is tempting to view recent losses by the Adani Group as a success for activist investors, but the short-selling campaign was based on allegations of fraud by a self-interested financial firm not their record on climate change. Activist investors are successful in proportion to their wealth, and are shy about genuine climate action in proportion to their wealth.

For ordinary people, it is nigh-on impossible to intervene. Turning up at an annual general meeting and voting against the board or in favour of net zero targets is like buying a ticket to a blockbuster film and not clapping at the end to protest: they still get your money. As Buller writes, while there is an ‘intuitive logic of using one’s leverage as a shareholder to demand change, in practice the threat of this shareholder democracy is not usually all that thrilling or impressive.’ The dominant trend of major fossil fuel firms is re-branding themselves as ‘green energy’ suppliers, or corporations taking up the mantle of ‘ESG’ bodes ill for climate action or a just transition.

The offset regime

One key strategy in the armament of green capitalism consists of carbon offsets, emissions trading and the carbon credit schemes developed by governments along with their corporate advisors. Offsets and credits both aim to build into market transactions the cost of polluting, which has historically been an unaccounted ‘externality’. Carbon pollution can be priced into corporate books, and so priced out of notice. But such schemes maintain the system of accumulation and incentivise profit-making uses of new markets, rather than contribute to reducing emissions.

Capitalism is an ‘externalising machine’, Buller writes, ‘constantly in pursuit of mechanisms through which profits can be maximised by minimising or altogether evading the true costs of economic activity.’ In order to avoid paying for their real emissions, companies such as the French oil giant Total use the lowest possible measure of their emissions as the basis for their offsets, ignoring completely the effects of burning the fuel they pipe and instead focusing on operational emissions. Carbon markets on which offsets and credits are traded aim to price carbon in order to ‘unleash the decentralised power of capitalistic … inventive genius’ and encourage ‘investing in economically efficient carbon-avoiding alternative technologies,’ according to the economist Martin Weitzman.

The price mechanism is vulnerable on two fronts, aside from the concerns I described above about the abstracting effects of financial markets. Firstly, governments and other institutions ensure the cost of carbon is well below real cost. And, secondly, speculative activity distorts the price, allowing investors to bet on price fluctuations. Most activity on exchanges, Buller reports, ‘takes place not between investors and firms, but between the hands of traders.’ This distorting effect is something Scott Hamilton and Stuart Kells note of the water markets draining the Murray Darling Basin Authority of legitimacy and contributing to water shortage, mismanagement and environmental destruction.

The offset market in Australia has been repeatedly exposed as propped up by faulty methodologies, playing into the hands of mining interests, and used for profit rather than environmental restoration. Although they make little to no contribution to carbon emission reduction, governments rely on these mechanisms to claim progress towards their climate targets. Schemes that claim to sequester carbon in improved soil through regenerative agriculture practices have received support from the likes of Charles Massy in his well-regarded Call of the Reed Warbler. Massy describes in glowing terms a sustainable livestock management company as an ‘investment vehicle’ that has raised over $70 million to purchase fifteen properties to transform land.

What is revealing about Massy’s praise is that he describes carbon sequestration in economically rational terms as a growth strategy, with one project ‘more than doubling wool and meat production.’ The legitimacy of these projects is not only their regenerative effect but their productivity dividends. Moreover, Massy cites projects supported by The Nature Conservancy, an NGO that according to Buller has been implicated in buying land from wealthy owners that is already committed to conservation and then circulating it on the carbon credit market.

Offsets are attractive to governments and financial investors because it allows emissions to continue to grow while claiming to be progressing towards net-zero targets. By using methodologies that compare the ‘theoretical maximum difference between existing plans and an imagined alternative scenario,’ corporations turn carbon credits into branding exercises at minimal cost.

Carbon offsets are also directly linked to an ‘imperial mode of living’ by sequestering the lands of indigenous people and enclosing it against sustainable agriculture use. Like the eco-centric conservation model, which fetishes ‘untouched’ or ‘wild’ land, offset markets are implicated in further injustices feeding the rich world’s appetite for a clean conscience. Buller enumerates some effects:

the forcible expulsion of Indigenous communities from their homes; the razing of long-standing communities to clear the way for ‘conservation’ and offset projects; the seizure of land occupied by subsistence farmers, devastating communities that had previously provided for themselves; and, ironically, deleterious effects on local ecosystems through the substitution of mono-species tree plantations for indigenous biodiversity.

The cost of green capitalism

Market-based solutions to climate change, as the offset regime demonstrates, are not only empty—they are actively destructive and fuel continued expropriation and accumulation. If offset markets are at best ineffective, the use of financial markets represents a means to de-politicise climate action. The high level of public concern about climate change is being channelled and appeased by ESG branding, carbon-neutral certification and the use of offset markets that generate new colonial ‘elsewheres’.

Buller is rightly adamant that we cannot have it both ways: financial markets cannot continue to grow, and asset managers cannot succeed in the pursuit of climate justice. The demands of justice directly undermine the interests of asset managers. This necessary conflict is being obfuscated by market-friendly technocratic economic management. Like many centre-left parties in governments, Labor is committed to some version of green capitalism. This comes in the form of ‘public-private partnerships’, regulative integrity and continued economic growth.

The kinds of regulation that result from the cosy relationship between corporate consultants and government tend to emphasise disclosure regimes, which are easy to meet and contribute next to nothing to a net-zero target. Meanwhile Buller is scathing about the public-private partnership model, arguing that it involves ‘backstopping private profits by socialising risk and privatising profits from joint ventures.’ While it is meant to encourage investment, Buller’s analysis shows it has played little role in raising capital for the large-scale infrastructural changes necessary to transition an economy.

Although Buller is critical of the technocratic, anti-political effects of financial capitalism and its illusions of climate action, the level of analysis remains relatively disconnected from the kinds of political movements that might contribute to a democratic, just transition. Capitalist markets erase human values and interpersonal agency, replacing them with impersonal domination and inhuman metrics that actively erode any texture of the relationship humans have to nature. Buller’s focus on the most powerful, most efficient instruments of capital accumulation risks fulfilling Raymond Williams’ warning about ‘making despair convincing, rather than hope possible.’

Yet hope seems a lofty response to financial capitalism, whose markets float on clouds of the stuff. Buller bookends the analysis of green capitalism with the image of the whale, and its transformation into a pocket of financial value. The whale is a curious emblem, renowned for its ponderous beauty and yet a target and occasion for savage expeditions, leading Ishmael to remark, ‘yet man is a money-making animal, which propensity too often interferes with his benevolence.’

Financialisation is an interfering project, outsourcing, transmuting and displacing what we, in other conditions, might value. Whalers’ harpoons were notoriously sharp. It will be hard to extricate ourselves from our entanglement in financial markets. Rather than the self-congratulatory moralism of ‘saving’ heroics that often attends the image of the whale, considering financial capitalists as contemporary whalers offers a gruesome metaphor that might yet steel us for the struggle.

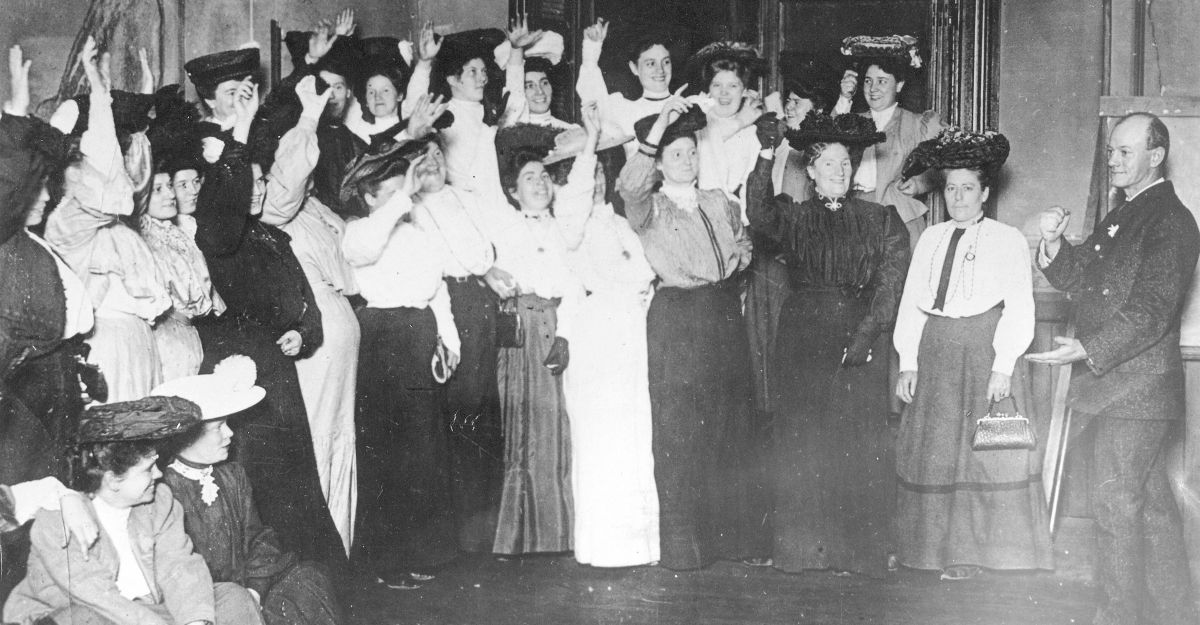

Image by Gabriel Dizzi