In the early weeks of the pandemic, when Covid-19 was regarded as a problem that would primarily affect Chinese international students, the universities scrambled to provide assurances that they were in a strong financial position to weather the crisis. On 19 February, it was widely reported that Australia’s major universities had $12 billion in cash reserves. Two weeks later, the universities were singing a different tune, shedding casualised staff and hinting at more job losses to come.

Australian universities have run surpluses for the past decade, capitalising on the exponential growth of full-fee-paying international students. The sector was considered so lucrative that in 2017 Scott Morrison, then Treasurer, announced a 2.5 per cent efficiency dividend on the Commonwealth Grant Scheme in an effort to claw back government funding to universities. Comparing universities to corporate entities, Morrison said at the time: ‘Now, if you add companies running around today saying that they’ve got 6 per cent profits, when on average it’s less than 1 per cent, you’d be thinking there’s a bit of room there – and you’d be right.’

Despite this decade of record gains, the entire sector fell almost immediately into arrears with the onset of Covid-19. As the flow of international students was interrupted, universities were thrown into financial strife before even one semester had passed. Budgets for casualised staff, who make up roughly 70 per cent of the teaching workforce at major universities including G08 universities such as UNSW, USyd and University of Melbourne, were instantly slashed. In recent weeks, UNSW, University of Melbourne, Monash and Deakin have announced that triple-figure redundancies will be made for permanent staff. The question on everyone’s lips has been – where have all the surpluses gone? How could such large institutions fail so quickly, and have made so little provision for the day when profit margins would inevitably shrink?

Education is now Australia’s third-largest export, surpassed only by exports of iron ore and coal. It is our largest services export, contributing $37.6 billion to the Australian economy in 2018-19 alone. The increasing sums brought in by the education sector have been accompanied (perhaps enabled) by the marked and visible corporatisation of the university structure. Progressive government funding cuts have pushed the university in this direction by placing further emphasis on making the university profitable, ostensibly so that it can pay for itself and be less reliant on the public purse.

The solution for many universities has been to increase the number of international students. Recent modelling by the Mitchell Institute found that over the past decade, university revenue from international students grew by 137 per cent. The benefits from these international students ripple throughout the wider economy. The Mitchell Institute report also noted that ‘Australian Bureau of Statistics (ABS) figures show that for every $1 universities collect in tuition fees there is another $2 of other activity associated with international students.’ As international students brought new wealth into the university system, the salaries of university management, its vice chancellors in particular, soared accordingly to move in line with corporate salaries. But the relentless efficiency drives inspired by corporate culture failed to take account of a very fundamental truth: the university remains a non-profit entity and cannot function, in its day-to-day business, as a corporation does.

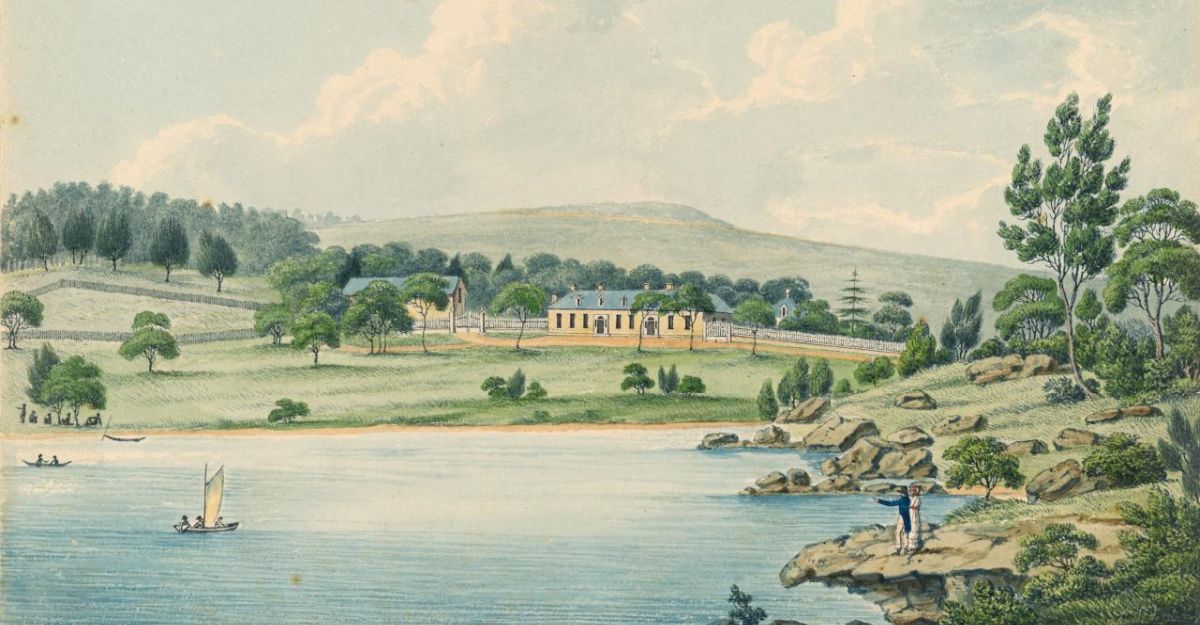

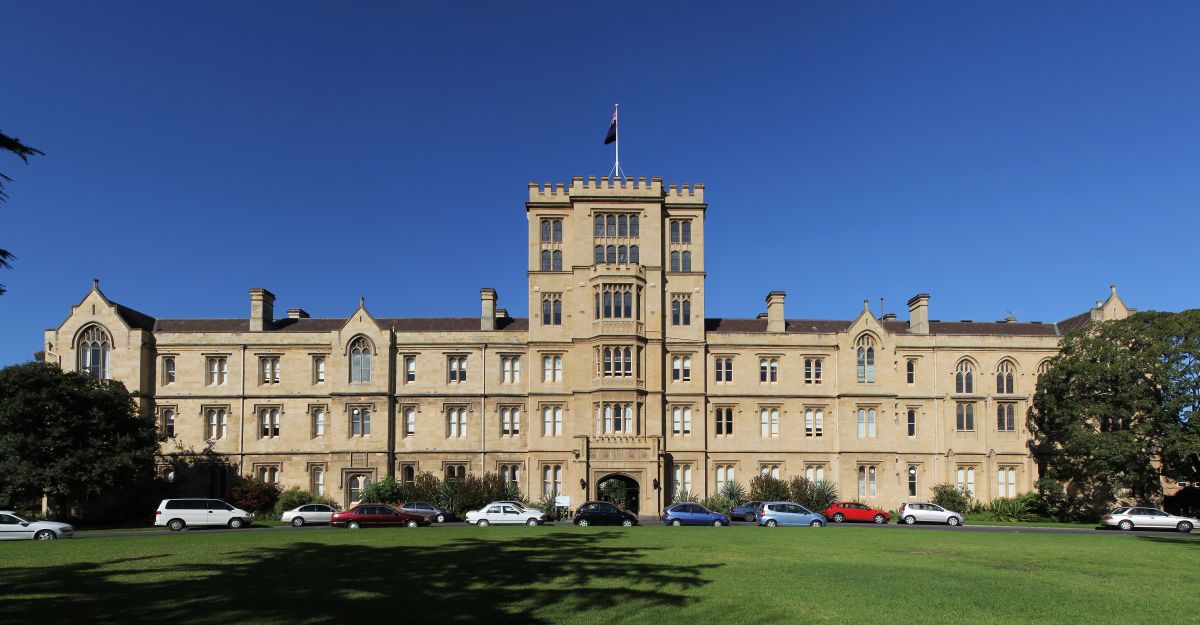

Because the university is a non-profit entity, it has no real ability to convert surpluses into genuine long-term assets. The largest assets on its books – land and buildings – do not in themselves generate revenue. In many cases, buildings rest on government land and cannot be sold. There are obstacles to the university renting out these buildings, or parts of these buildings, as commercial spaces, partly because they are often purpose-built as teaching spaces and are not easily converted into areas for commercial activity.

In reality, the university’s principal assets are its people: the academics who conduct original research and who impart specialised knowledge to their students, and the students themselves. But a financialised perspective has no capacity to recognise people as assets. On the balance sheet, academics are converted into liabilities in the form of salaries that must be paid, while the students are translated into a revenue stream that must be ever-increased, even though the university has no ability to capture profits for the longer term.

As non-profit entities, universities must ensure that any profits are expended by the end of the financial year. The surpluses they have run for decades have therefore disappeared and were always going to disappear. Corporatisation has promoted greater efficiencies and the continual increase of profit, but also incentivised universities to increase expenditure. Money is spirited out of the system via inflated executive salaries and profligate spending on consultants and advertising, or it is funnelled towards expensive vanity building projects which appear on the balance sheet as assets but are revealed, in times of crisis, as liabilities. The Dr Chau Chak Wing Building at UTS, for instance, was designed by Frank Gehry and built for an estimated cost of $180 million, roughly twice the cost per sq m as comparable academic buildings. This figure would go some way to alleviating the $200 million plus shortfall recently announced by UTS but, having no means of recuperating its building costs, the university has instead raised the prospect of 500 job losses in the coming year.

The justification for these expenses has been that universities need improved facilities to attract more international students, because international students are needed to fund universities. Covid-19 has now exposed the tautological nature of this argument. It is evident that increasing the numbers of international students in the system has not helped the university achieve financial independence. They have instead simply made the university more dependent on funding from international students. Now that this revenue stream has dried up, the universities’ inability to make use of its surplus capital has become apparent. When asked recently why the Future Fund could not be accessed to help pay for salaries during this time of crisis, the Chief Financial Officer and the Dean of Arts at the University of Sydney told the faculty that this money had been set aside to pay out redundancies. The only future that has been planned for, at USyd and most likely at other universities across Australia, is one that involves the exclusion of academics from the system.

We must ask why the university has embarked on a decades-long restructuring along corporate lines when the institution itself was never in a position to benefit from these surpluses. As universities nationwide face eye-watering budget deficits, management has taken predictable measures to help balance the books, seeking to slash expenditure on staff salaries and to develop strategies to maintain student revenue whilst demonstrating a palpable reluctance to open their books to outside scrutiny. In April, the National Jobs Protection Framework initially negotiated between National Tertiary Education Union (NTEU) and the Australian Higher Education Industry Association traded salary reductions in exchange for the oversight of university finances by an external National Expert Panel. The agreement collapsed when seventeen universities subsequently indicated they would refuse to sign.

In all this, there has been little discussion of the flawed model that underpins the modern university, or how ill-suited the financial perspective is to a field such as education, the benefits and true value of which are always intangible. Universities have been quick to push back against the education reforms announced in recent weeks by Dan Tehan. They would do well to reflect on how their own willingness to adopt the language and ideals of financial marketisation has contributed to the overall devaluation of the tertiary education sector. True leadership could have been shown by building solidarity across all levels of the university (management, administrators, staff and students) and mounting a concerted campaign against the government’s refusal to give universities access to the JobKeeper scheme. Instead, by trying to keep the people who are increasingly asked to do the bulk of the university’s teaching and research – their casualised staff – off the books, universities undercut their own arguments about being significant employers in need of support at a time of crisis.

Morale across the board has plummeted in the face of looming job losses and sector-wide uncertainty, both for staff and for students. But it is important for us to ask, with an eye to the future, how the system can be restructured to ensure that we emerge, post-Covid, in a stronger position than before. The answer does not simply lie, as a recent news item suggested, in finding new markets to replace the lost stream of international students, or in placing our faith in a leaner, more efficient university that will continue to process the same volume of students with fewer continuing staff.

In a world that has been irreparably changed, this is the time to invest in the future. We must recognise the university as something more than a commercial entity and guard against the transformation of higher education into a service sector that issues vocational degrees to paying customers.

The importance of the university hinges on its ability to exist as a space separate from other institutions; it is this distance that enables it to conduct analysis and critique without undue prejudice. Autonomy, and this includes financial autonomy, is essential if the university is to operate as society’s ‘critic and conscience’, a description enshrined in New Zealand law by the 1989 Education Act and raised more recently in response to the passage of the Higher Education and Research Act 2017 in the UK. By protecting the unique character of this space, we demonstrate that there are different ways for society to function and therefore challenge people to imagine different futures. These are the axioms that support the larger ambitions of higher research, the significance of which has never been clearer than at this present moment as the global economy waits for researchers to find the vaccine that will end this pandemic. The knowledge held by the university’s staff and the value in transferring this knowledge to younger generations are incalculable, in that they cannot be captured by financial metrics. They are, quite simply, priceless.